Present value of defined benefit pension calculator

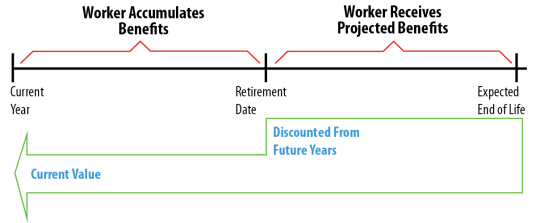

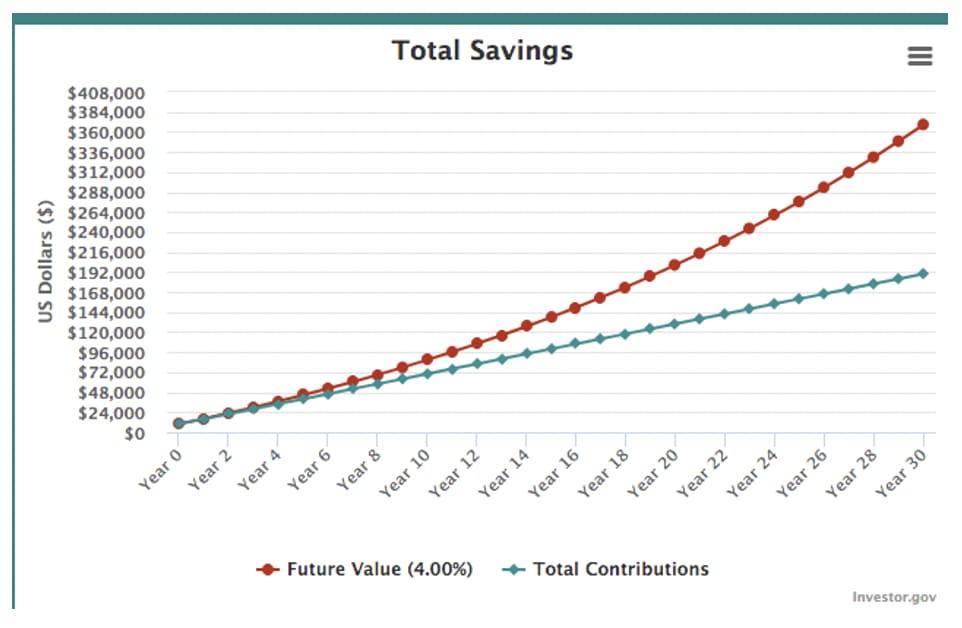

Personal finance is defined as the mindful planning of monetary spending and saving while also considering the possibility of future risk. Present value is a formula used in finance that calculates the present day value of an amount that is received at a future date.

Defined Benefit Pension Plan

Personal finance may also involve paying for a loan or other debt obligations.

. Personal finance may involve paying for education financing durable goods such as real estate and cars buying insurance investing and saving for retirement. You must reduce the 50000 amount if you already had an outstanding loan from the plan during the 1-year period ending the day before you took out the loan. In this type of pension plan employers guarantee their employees a defined amount or benefit upon retirement regardless of the performance of the investments involved and with certain tax advantages.

The payout depends on how well the fund does. Age 55 or older with at least 20 years of service credit. Actuarial assumptions for this purpose are specified in the Defined Benefit Plan Document.

There is less of a reduction if you have 30 or more years of service credit. See our defined benefit page for more information. The benefit of an employee is computed taking into account his age earnings tenure of service etc.

Option 2 Your monthly benefit is reduced based on your age and gender and the age and gender of your survivor annuitant at retirement. Were proud to have received our 13th consecutive Gold Rating from SuperRatings for being a good value for money super fund plus we have won the SuperRatings Infinity Award seven times for our commitment to environmental and ethical. When people throw around the term pension plan the Defined-Benefit DB plan is typically what they are referring to.

In its simplest form the assumption basis is comprised of an interest rate and a mortality table. If you are a peace officer or fire fighter then your pension benefit in the PERS Defined Benefit Plan will be calculated based on the three highest consecutive payroll years regardless of when you first entered the PERS. Actuarial Assumptions for Defined Benefit Plans.

Actuarial Gains Losses. The normal retirement benefit is reduced by an early retirement factor so that the present value of the account is actuarially equivalent. You can also test your retirement-spending strategy by using T.

The Department believes that plan administrators of frozen defined benefit plans will provide the notice of statement availability as described in section 105a3A to frozen defined benefit plan participants in lieu of a pension benefit statement at an all-inclusive cost of approximately 075 per paper 015 per electronic notice. The reduction correlates to how far away the member is from superannuation age. Amounts below this value will only be offered where the proceeds are from a contract issued or administered by the Company where compulsory purchase of an annuity is required and to the subscribers of the National Pension System regulated by the Pension Fund Regulatory and Development Authority PFRDA.

A Defined Benefit Pension Plan is one where a specified pension payment lump-sum or combination thereof is paid to the employee by his employer. Different fees and charges apply for this service. The percentage multipliers for peace officers and fire fighters are.

The FTSE Pension Liability Index reflects the discount rate that can be used to value liabilities for GAAP reporting purposes. The federal securities laws require clear concise and understandable disclosure about compensation paid to CEOs CFOs and certain other high-ranking executive officers of public companies. A MULTI AWARD-WINNING FUND.

An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream. In effect the member receives less each month because the benefit will be received over a longer period of time T-E. Actuarial assumptions are used to calculate the APVs for actuarial equivalence in Defined Benefit Plans.

Once this is determined then a valuation date must be established. The second the defined contribution plan is the familiar 401k plan. 2 for their first 10 years of service times AMS.

Half the present value but not less than 10000 of your nonforfeitable accrued benefit under the plan determined without regard to any accumulated deductible employee contributions. Separate property requires a. Amounts recognised in Balance Sheet.

Age 65 or older with at least five years of service credit or. Pre-defined with reference to number of years of service and salary. The Employee Retirement Income Security Act of 1974 ERISA does not require employers to provide pension plans but does set the minimum standards for those employers who offer pension plans.

General Enquiries 1800 103 1906 Tollfree 1800 220 229 Tollfree - Covid Support 022 40919191 chargeable number 24 X 7. Tax benefit under Section 80 CCD and 80 C. While winning awards isnt everything its great to see that doing the right thing has paid off.

Defined Benefit Pension Plan. Several types of documents that a company files with the SEC include information about the companys executive compensation policies and practices. There are two types of pension funds.

Your benefit will be reduced if you are under age 65. If at the time of your death you have not received in monthly benefits an amount equal to your accounts Present Value then the balance is paid to your beneficiaryies. Plan 3 Defined Benefit provides a retirement.

The first the defined benefit pension fund is what most people think of when they say pensions The retiree receives the same guaranteed amount. Figure 2 shows the amounts recognised in the Balance Sheet. However the characterization of the account community vs.

The first thing that must be established is whether the pension is a defined benefit or a defined contribution plan. Plan 2 provides a retirement benefit at. If youre looking for advice on your investments see our investment advice page.

Created in 1994 it is a trusted source for plan sponsors and actuaries to value defined-benefit pension liabilities in compliance with the SECs and FASBs requirements on the establishment of a discount rate. Another key component to be recognised is the actuarial gains or lossesThese arise due to changes in assumptions and based on the accounting standard they are classified either into the PL account or into a separate account. The Pension benefits in benefits calculator is a retirement plan that pays a fixed monthly amount each year during retirement like an annuity.

These are employer-sponsored retirement plans. Minimum- Rs500 per month Tier 1 and Rs250 Tier 2 No contribution made as this scheme works under a pre-defined module of pension provision after retirement. The premise behind the calculation is the concept of the time value of money or in other words that its more valuable to receive something today than to receive the same value at a future date which is why.

Find helpful financial information based on where you are in life explore financial information from trusted resources and use tools to make more informed financial decisions at mymoneygov. If your pension savings are less than 75000 were still here to help. We also offer advice on defined benefits pensions sometimes called final salary pensions.

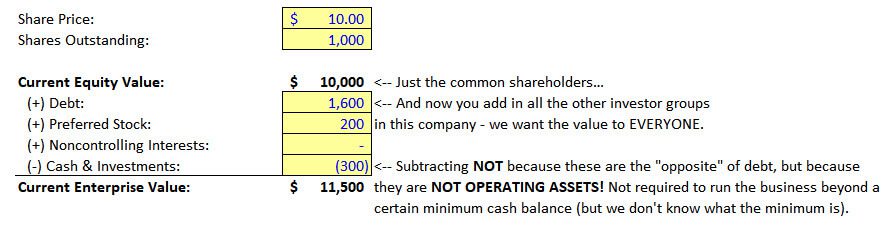

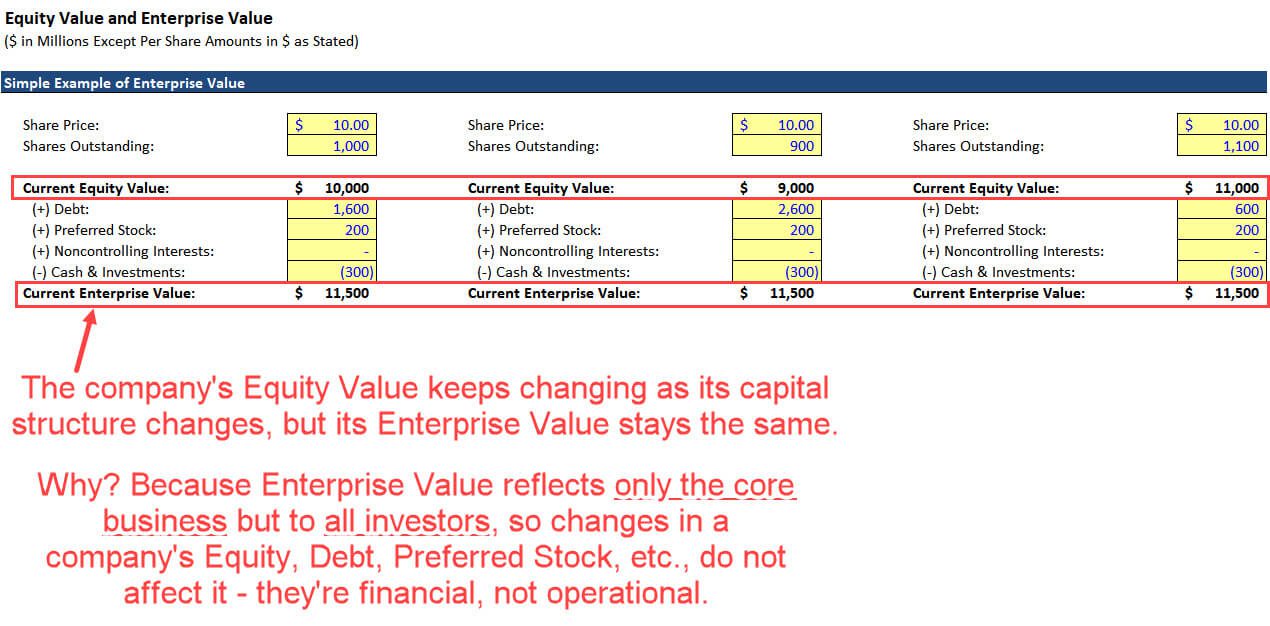

The value of a defined contribution plan is simply the balance of the account as of a given date.

2

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

What Is A Liability

How To Calculate Enterprise Value 3 Excel Examples Video

About Soa

Measures Of A Defined Benefit Pension Obligation Cfa Frm And Actuarial Exams Study Notes

2

Multiemployer Defined Benefit Db Pension Plans A Primer Everycrsreport Com

2

How To Calculate Enterprise Value 3 Excel Examples Video

2

Retirement Planning The Ultimate Guide For 2022

Canadian Armed Forces Pension Plan Canada Ca

2

How To Calculate Enterprise Value 3 Excel Examples Video

Multiemployer Defined Benefit Db Pension Plans A Primer Everycrsreport Com

How To Calculate Enterprise Value 3 Excel Examples Video

How To Calculate Annuity Factor For Present Future Value Of Annuity